State Tax ID information is only needed for states in which you have a physical presence (‘nexus’). If you’re not based in the United States, you might be asked for this in error contact Amazon and it should be cleared up in a couple of days.

Federal Tax ID number: When you’re in the process of signing up to your Amazon account, you’ll need to fill in a 1099-K Tax Interview document. If you’re selling as an individual, have your Social Security number handy if you’re selling as a company, you’re going to need your company’s Tax ID and State Tax: You’ll need your tax ID. Credit card: You’ll need to have the credit card you’re going to use for your business handy and solvent.

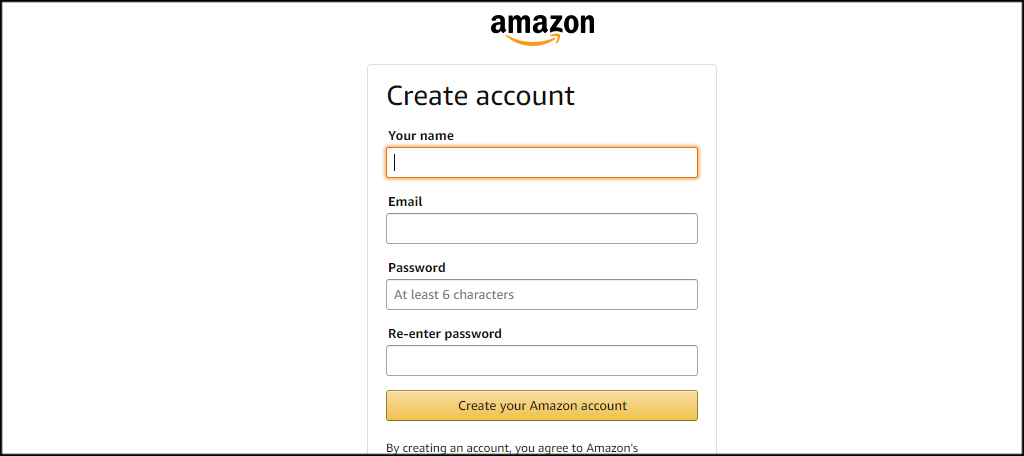

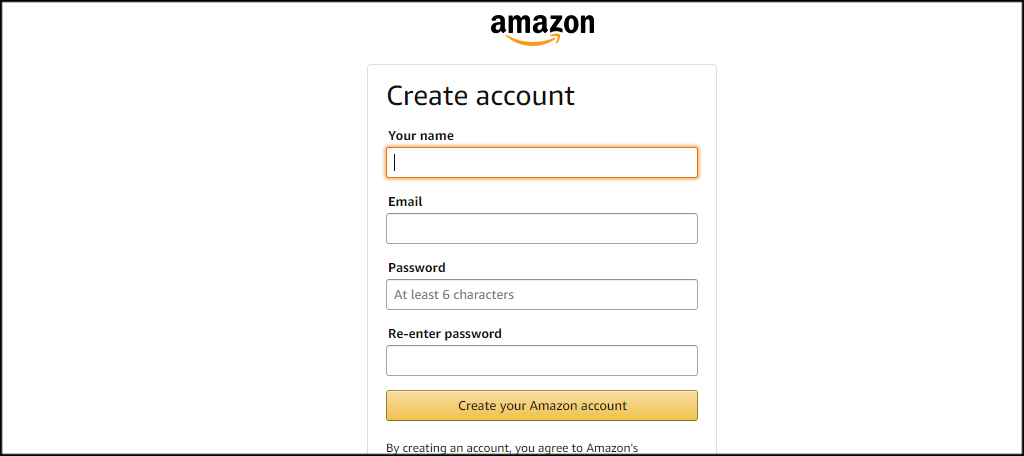

But I’d consider setting one up especially for your Amazon seller account – maybe add a new account to your business email or if you don’t have one, open a fresh Gmail and keep signed in on an alternative browser so checking it regularly is easy.

Email: You’ve got to have a valid email address. Here’s a quick guide on how to start an online business. If you’re doing business as another name, things get more complex, but you’ll need this whatever you do. Your business name: The name of your business. Some of this will be needed for the account opening process, some of it is common sense, and some of it helps to protect your business in the future. It’s a lot easier to start selling with your paperwork in order. Paperwork you need to start selling on Amazon

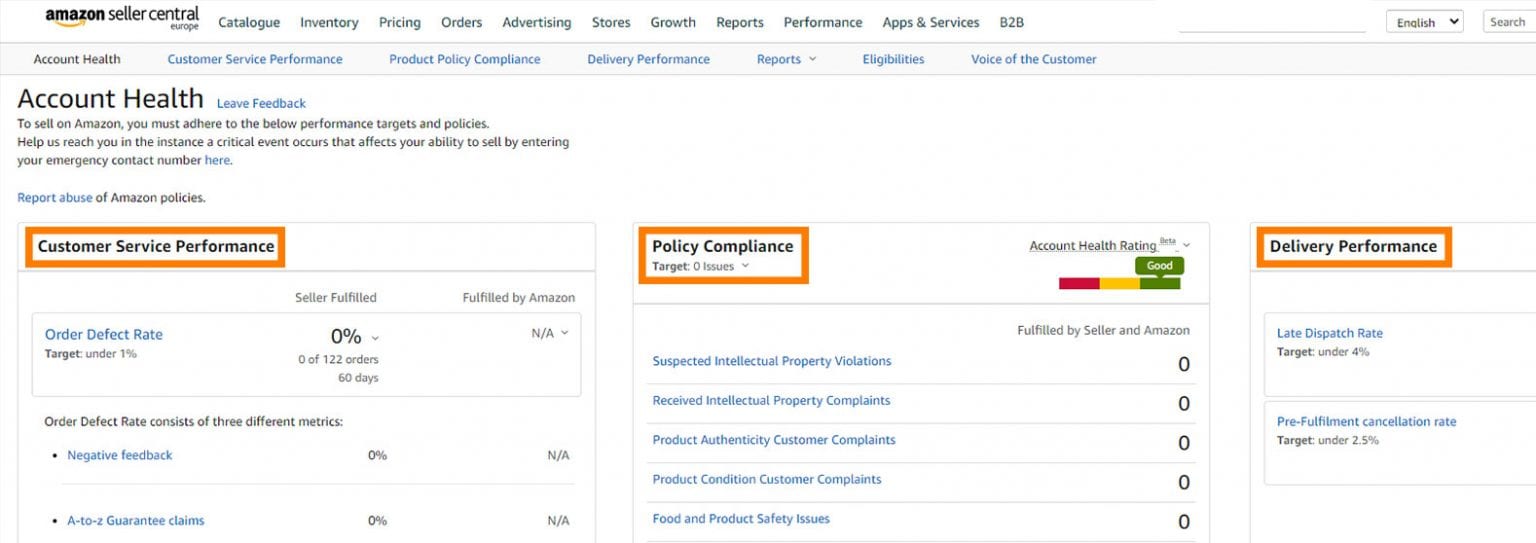

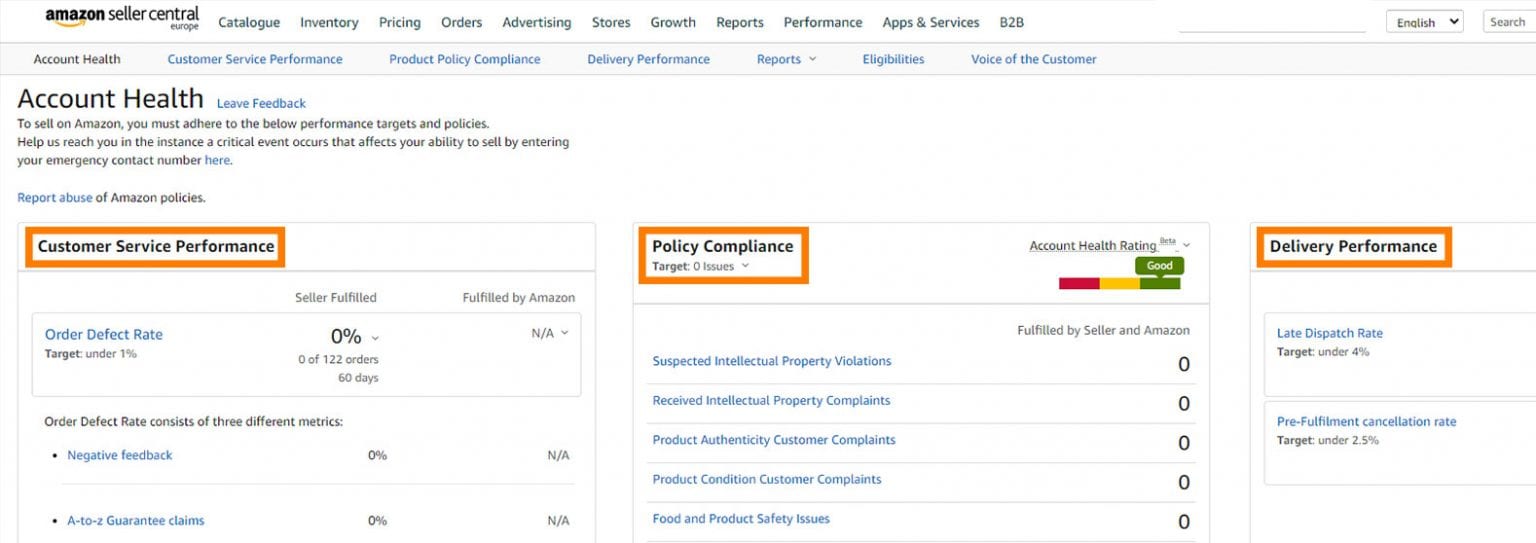

To start selling on Amazon, you’ll need to start with these steps: We’ve covered everything from the most basic preparation to the next steps necessary to grow into your success. And being prepared makes all the difference: with this checklist, you’ll be ready to ace every step of selling on Amazon. Amazon will hold you to its monthly performance metrics from day one. The moment you sign up as an Amazon seller, the clock starts ticking.

0 kommentar(er)

0 kommentar(er)